Of the different kinds of 401(k) designs for small businesses, the one plan I often recommend is the safe harbor 401(k) because it’s a great way for employers to reward employees and simultaneously save themselves tons of administrative hassle. So, what’s so special about a safe harbor plan? Let’s review.

What is a safe harbor 401(k) plan?

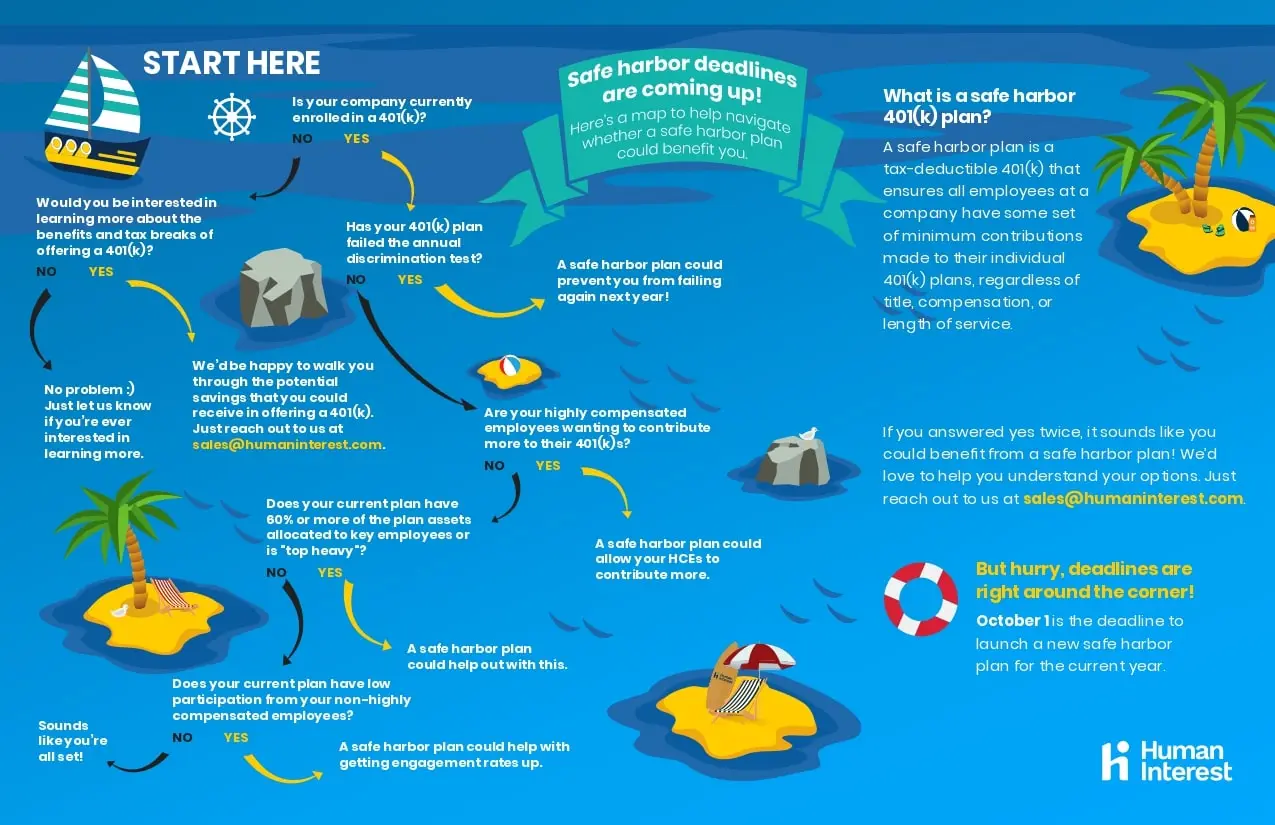

A safe harbor 401(k) plan is a tax-deferred 401(k) plan that ensures all eligible employees at a company receive an employer contribution made to their individual 401(k) plans, regardless of their title, compensation, or length of service.

When is safe harbor relevant for your company?

Safe harbor plans can be very beneficial, but there are certain circumstances that make these plans even more advantageous, such as:

How will I know if a safe harbor plan will benefit me?

Let’s make it simple. Follow the questions on the map to see if a plan is right for you.

What are the requirements of a safe harbor 401(k) plan?

Unlike other types of matching, in which employers can choose a certain vesting schedule, safe harbor matches must be immediately vested for all employees. Additionally, to meet the minimum requirements, your company must meet ONE of the following contribution formulas for your plan to be considered a legal safe harbor plan:

Elective (enhanced match): Your company matches 100% of all employee 401(k) contributions, up to 4% of their compensation

Elective (basic match): Your company matches 100% of all employee 401(k) contributions up to 3% of their compensation, plus a 50% match of the next 2% of their compensation

Non-elective: Your company contributes 3% of each employee’s compensation, regardless of whether the employee also makes contributions

Which safe harbor contribution formula should you consider?

A safe harbor match design is best suited for employers that want to actively encourage employees to save by motivating them with the matching employer contribution. An employee will only receive a safe harbor match contribution if they make employee elective deferrals to the plan. At Human Interest, the 4% safe harbor match is the most common type of match among our customer base*.

If you want to go above and beyond for your employees, you can offer a higher percentage match and still qualify for safe harbor. Non-elective contribution safe harbor designs are more expensive for the employer, but there are times when a non-elective formula makes sense, due to:

1. Timing restrictions when implementing a new safe harbor design

2. HR issues related to recruiting and retaining employees

3. Plan design issues that make having a nonelective contribution beneficial to the employer

Because safe harbor contributions must be made annually, companies are implicitly required to have strong cash flow to meet their commitments. Actively managing your company’s safe harbor 401(k) plan can help ensure your company can make contributions in full and on time.

What’s the most important thing I should know about safe harbor 401(k) plans right now?

Safe harbor 401(k) deadlines

Safe harbor plans have strict deadlines. We recommend communicating with your service provider as early as possible to determine if there are any timing limitations at the service provider level, in addition to the legal deadlines, that may restrict your ability to implement the safe harbor plan design of your choice.

October 1, 2023 is a Big Deal

The first year (“initial year”) of a new safe harbor 401(k) plan (for both match and nonelective type designs) must be at least three months long, meaning the opportunity to make elective deferrals from wages must be available for at least three months in the first plan year. This means the deadline to establish a new calendar year based plan is October 1.

If you’d like to learn more about safe harbor 401(k) deadlines, please reach out to me at mary.cecio@humaninterest.com. I can answer your questions and help you figure out if the plan is right for you.

*Human Interest internal data, 2022

Human Interest Inc. is an affordable, full-service 401(k) and 403(b) provider that seeks to make it easy for small and medium-sized businesses to assist their employees with investing for retirement. For more information, please visit humaninterest.com.